Investors who rely heavily on book value analysis are typically looking for good stocks that are temporarily underpriced by the investment community. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

- If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases.

- The term “book value” is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books.

- Consider technology giant Microsoft Corp.’s (MSFT) balance sheet for the fiscal year ending June 2023.

- What we’re looking for is the number of shares outstanding, not simply issued.

- ” And you may need your RV’s value if you want to sell or trade in to upgrade or downsize.

- As long as the accountants have done a good job (and the company’s executives aren’t crooked) we can use the common equity measure for our analytical purposes.

Create a Free Account and Ask Any Financial Question

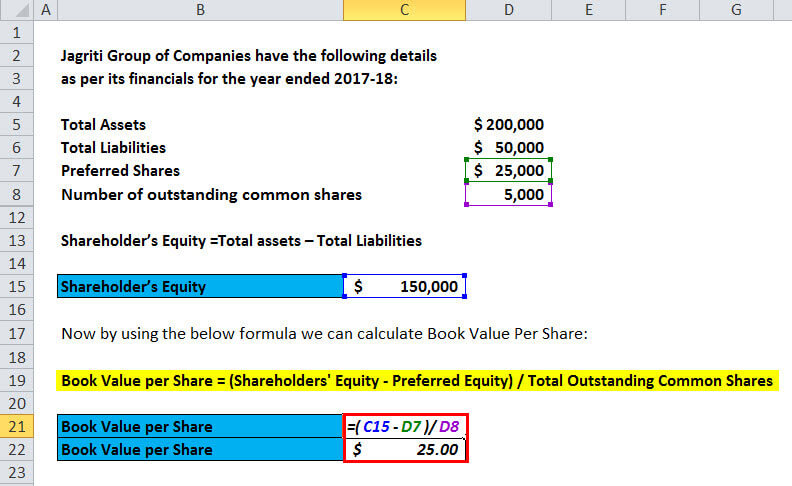

Book value is the value of a company’s total assets minus its total liabilities. The book value of common equity in the numerator reflects the original proceeds a company receives from issuing common equity, increased by earnings or decreased by losses, and decreased by paid dividends. A company’s stock buybacks decrease the book value and total common share count. Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share.

Book Value per Share

Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool. Should the company dissolve, the book value per common share indicates the dollar value remaining for common shareholders after all assets are liquidated and all creditors are paid. It is quite common to see the book value and market value differ significantly. The difference is due to several factors, including the company’s operating model, its sector of the market, and the company’s specific attributes. The nature of a company’s assets and liabilities also factor into valuations.

Book Value Per Share (BVPS)

The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. Book value per share (BVPS) measures the book value of a firm on a per-share basis. BVPS is found by dividing equity available to common shareholders by the number of outstanding shares. The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share. The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future.

Formula to Calculate Carrying or Book Value

There are three different scenarios possible when comparing the book valuation to the market value of a company. As the market price of shares changes throughout the day, the market cap of a company does so as well. On the other hand, the number of shares outstanding almost always remains the same.

The Net Book Value (NBV) is the carrying value of an asset recorded on the balance sheet of a company for bookkeeping purposes. A business should detail all of the information you need to calculate book value on its balance sheet. Learn how to calculate the book value of an asset, how it helps businesses during tax season, and why it’s less helpful for individuals who don’t run a business. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The carrying value of an asset is its net worth—the amount at which the asset is currently valued on the balance sheet.

To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity.

As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it. If book value is negative, where a company’s liabilities exceed its assets, this is known as a balance sheet insolvency. On the other hand, investors and traders are more interested in buying or selling a stock at a fair price. When used together, market value and book value can help investors determine whether a stock is fairly valued, overvalued, or undervalued.

Otherwise, the short-term asset with a useful life less than twelve months, such as accounts receivable (A/R) and inventory, is recognized in the current assets section of the balance sheet. They are listed in order of liquidity (how quickly they can be turned into cash). The book value shown on the balance sheet is the book value for all assets broadening the tax base and raising top rates are complements not substitutes in that specific category. As an accounting calculation, book value is different from an asset’s market value, which is contingent on supply and demand, and perceived value. It is strictly a measure of the company’s balance sheet values as of a point in time. Making Calculations Practical Now it’s time to use the calculation for something.

In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations. While this dip in earnings may drop the value of the company in the short term, it creates long-term book value because the company’s equipment is worth more and the costs have already been discounted. In this case, the value of the assets should be reduced by the size of any secured loans tied to them. If it’s obvious that a company is trading for less than its book value, you have to ask yourself why other investors haven’t noticed and pushed the price back to book value or even higher.

You shouldn’t judge a book by its cover, and you shouldn’t judge a company by the cover it puts on its book value. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.